Wood panels suppliers at their best

Favorable conditions have been provided for Russian factories to help them become the most effective furniture producers in the world. Will they use these opportunities?

10/04/2017

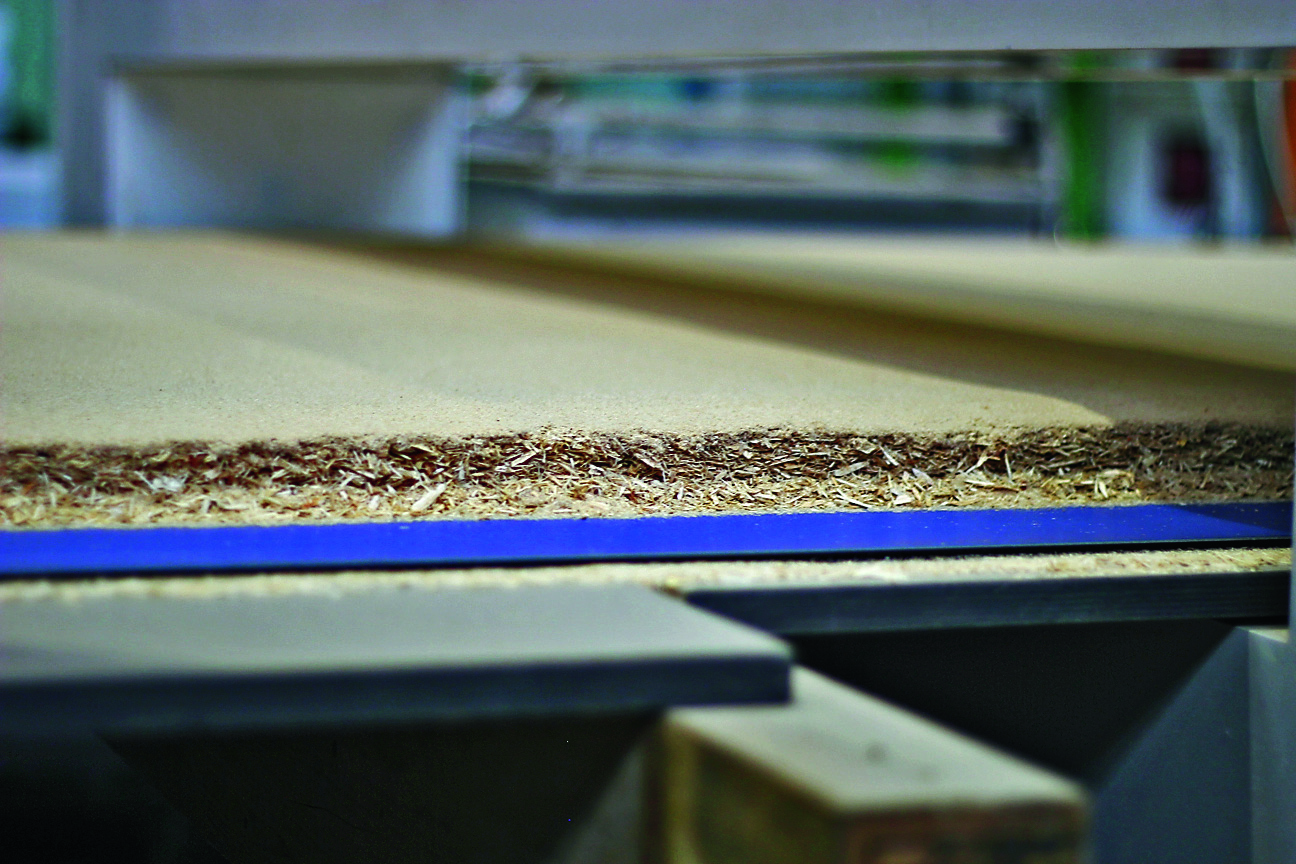

Russian wood-based panels producers have done their best to provide the internal market with the best quality and bestpriced wood panels. In quite a short term favorable conditions have been provided for Russian furniture factories to help them become the most effective furniture producers in the world. Will they use these opportunities?

Unprecedented growth

Russian wood-based panels market has never developed as rapidly, as it did in the last 7 years. Until 2009 Russia was lagging behind the leading regions by the volume of investment in the wood board industry, but the situation has started to change significantly since 2010. Investment into Russian board industry have surpassed the volumes of investment in Eastern and Western Europe, Latin America, China, which means that Russia is leading the list of the most attractive countries.

Half of the investment, financing construction and development of wood board sector in Russia comes from the five biggest foreign companies: Kronospan, Kronostar, EGGER, Kastamonu, Pfleiderer (the latter now belongs to IKEA). That’s according to Alexey Beschastnov, senior consultant at PÖYRY Management Consulting.

Russian wood board producers have also been gaining force: one after another chipboard, MDF board and OSB factories, which have been built on Russian money, were coming into operation.

“Today our furniture producers have all opportunities to become the most effective and successful producers in the world,” — Ardasher Kurbansho, Kronospan Director General in Russia, says. “In the last three years the board market has changed dramatically, as a result furniture producers have received advantages compared to their foreign colleagues.

In 2013 all board producers in Russia taken together were producing not more than 800 decors in 10 textures. Today we have over 2500 decors and more than 50 textures. Chip board prices have dropped from 150 to 60 euro per one cubic metre. This is the cheapest Russian boards have ever cost and probably will ever cost. By the technical capacity, many Russian factories are surpassing European ones, let alone American. One of my clients has become the biggest producer of kids’ furniture in Russia in two years. Half of his income now comes from export of his products to Germany. Today he is arriving from China where he held business negotiations and previously he spent time in Italy and Spain, where he is opening his branches. This approach, in my opinion, should be adopted by Russian producers of furniture.”

Achievement through difficulties

In 2015–2016 board producers faced difficult realia: decrease of demand on the internal Russian market, tough competition, prices in euro dropped almost three fold as expenses increased by 1,5 fold. However, according to Rosstat (Federal State Statistics Service), the board industry is in good shape right now. In 9 months of 2016 compared to the same period of 2015 production of boards has increased by 2,3%, reaching in general 5 million cubic meters. Joint production of hardboard has increased by 4,4% (around 400 million sq. m), including MDF boards — by 12% (255.6 million sq. m). Stable positive dynamics was seen in OSB and plywood segments.

How did board producers manage to maintain and even increase their production volumes?

As for chip boards, favorable results in the sector in general were secured by big up-to-date producers. Heavyweighters have increased board production by replacing products from old Russian factories. As it was expected, low-capacity factories using outdated technologies could not handle the competition and decreased production volumes significantly, while factories equipped with up-to-date machinery got 18% increase.

Russian MDF producers have almost completely replaced European importers from the market. Laminate market is enjoying rapid growth. The share of Russian producers in this segment has increased from 46% in 2012 to more than 70% in 2015.

In recent years Russia, which was on second place after the US by the volume OSB import, has managed to develop its own production and is providing itself with two thirds of these materials.

Export

Export has become an important factor of growth for such international companies as Kronospan, Kronostar, Kastamonu. Due to dramatic growth of foreign currency exchange rate, wood boards produced in Russia are much cheaper than the foreign ones for the first time in post-Soviet history and market leaders used this situation to their advantage. Export of MDF boards has increased by 50% compared to 2015. At the same time producers compete on European as well as Chinese markets successfully

According to experts’ estimates, in the next couple of years Russia can turn into a big OSB exporter.

Export of chip boards in 2015 was 1185.1 thousand cubic metres; in 2016, according to experts’ preliminary estimates, 900–1000 thousand cubic metres were exported.

Not everything goes so smoothly

Does it mean that board producers are looking into the future with optimism? It’s more likely that they can not make up their mind whether they should be proud of their success or concerned.

Internal consumption of MDF boards and especially chip boards has started falling since 2012, and in recent years this tendency has been growing. The reason for this is significant decrease of production rates cabinet furniture factories — the main consumers of wood boards. It is possible that export can turn out to be less attractive too. If a barrel of oil price rises, foreign currency exchange loses, which influences exporters significantly.

Meanwhile, new factories are being built and the existing ones are being developed, boosting competition on the market which is already overfilled with boards.

The situation is aggravated by the fact that a lion’s share of board production is concentrated in Central Russia, which is not as rich with forests, but has more or less developed infrastructure and relatively favorable conditions for investment.

“We think that chaos, caused by the appearance of new board factories is absolutely unacceptable,” — says Oleg Numerov, Director General of the Association of Russian producers of furniture (AMEDORO). “Construction of new factories should take into account the situation with raw materials and work force. In reality when it comes to choosing the location of the new factory, the main factor is loyalty of regional governments, who, in their turn, are hostages of a vicious practice: their activity is to a great extent estimated by the volume of attracted investment.

When around two years ago we learned that three factories producing wood-based panels are being built in central Russia, each of them having volume of one million cubic metres, we started ringing the alarm. We raised this issue in the Ministry of Industry and Trade, where the industry’s prospects were discussed. The reply was: leave it to the market to decide everything. But in fact the market doesn’t decide anything! The Association has made its position known to the government, we turned to the Security Council. Russia already has gone through a situation when within twenty years of the abolition of serfhood almost all wood in Tambovskaya, Voronezhskaya, Orlovskaya provinces was cut down. If developers of the new strategy of production development will not take into account the real threat, the situation may repeat itself.”

AMEDORO, uniting the leading board companies, is by no means talking about stopping construction of wood processing factories.

“Today we are using just one third of our forest resources, while timber industry’s potential is not significantly smaller than that of the oil and gas sector,“ — Ruslan Kurbanov, President of the Russian Laminat group of companies, Vice President of AMEDORO says. “If we boost wood processing industry, make products with higher added cost, our input in GDP, to the federal budget may increase several fold. But a unified strategy needs to be worked out, that is Federal Forestry Agency, Ministry of Industry and Trade, all interested ministries and departments need to unite their efforts.

Our association is currently actively cooperating with the company Strategy Partners Group, which is working on the strategic programmer of development of timber industry until 2030. We hope that as a result we will get a high-quality document, which can give an impulse to our industry”.

Anyway, in it’s self-development the Russian board sector has reached quite a lot, which in itself deserves interested and careful attitude of the government and society. On the threshold of further development — especially taking into account prospects of entering international markets — it needs a unified sector policy, clear and supported by all parties concerned.