Circular forces

How does the market of Moscow profile retail centers look like and what does future hold for them?

07/08/2017

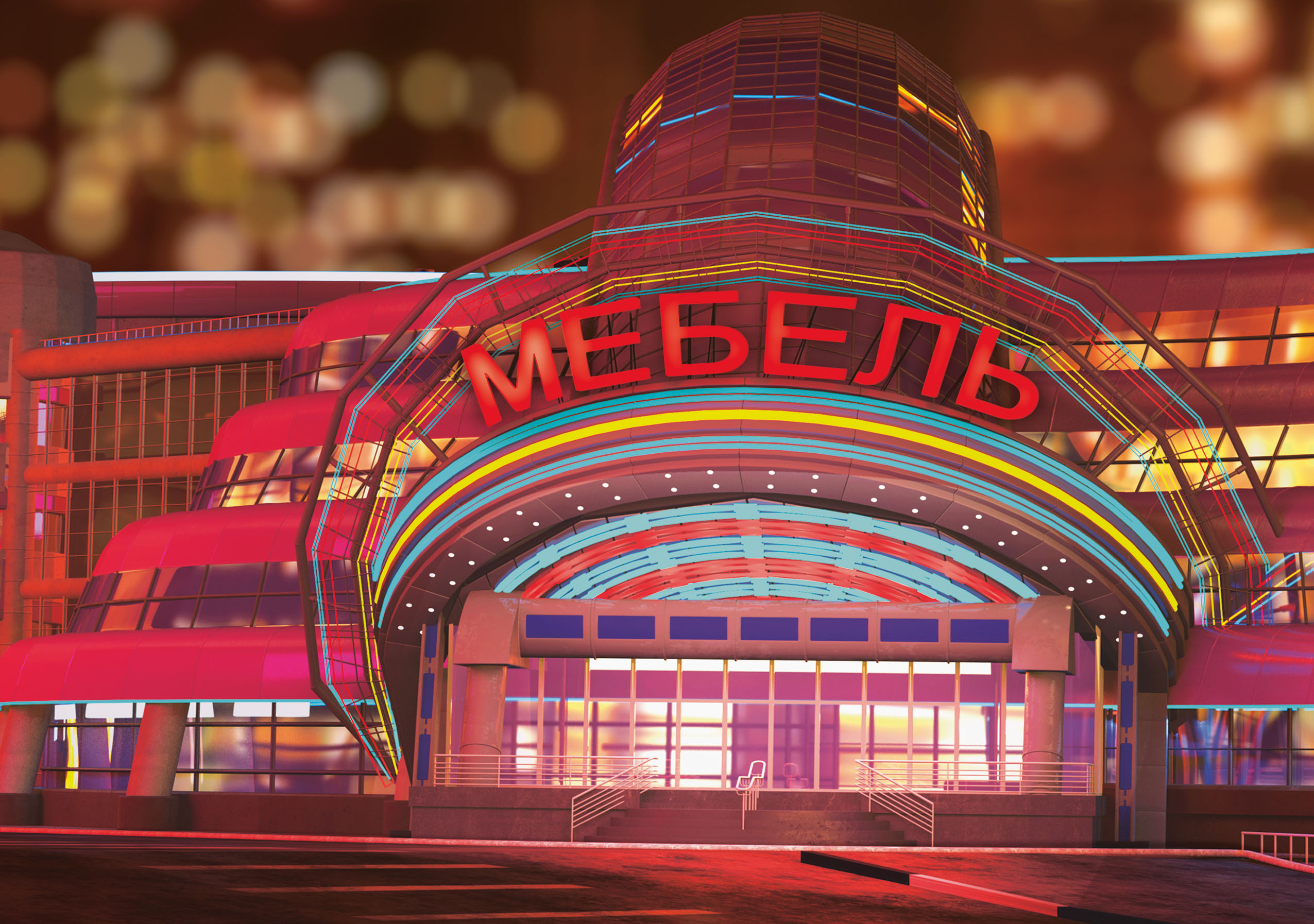

Shopping centre became the main furniture shopping format in Moscow and Moscow region. Specialized centres have consolidated and regulated furniture retail in Moscow, gathering all well-known retail projects and thousands of independent sellers in one place. How does the market of Moscow profile retail centers look like and what does future hold for them?

Almost one third of all sales on the Russian furniture market is in Moscow or Moscow region, which is by no means surprising: every tenth citizen of Russia lives and shops here. Plus hundreds of thousands of visitors from neighboring cities and regions.

The vast majority of furniture purchases — 70% is made in specialized shopping centres and centres with big furniture retail spaces. 12% of furniture deals are secured by hypermarkets — Ikea, Hoff, Ashan and Leroy Merlin. 7% of sales is online. Share of street-retail in the general volume of purchases made is 5%. And, finally, construction markets account for an insignificant 3% of the volume of sales.

Positions of specialized centres began strengthening in 2010. This time was marked by appearance of new big spaces, which eventually took over from street-retail. During a long period of time two furniture markуt giants — “Grand” and “Tri Kita” shopping complexes were unquestionable leaders in this sphere. They were opposed by relatively cheap subrential projects, such as “Mebel Rossii” working in periphery areas of Moscow. Only big furniture producers could afford renting spaces in “Grand” and “Tri Kita”. Average Russian producer was presented in retail spaces of lower rank.

The situation has changed as a couple of new large-scale projects have appeared. In the first place, we are talking about “Armada” furniture centre by Prazhskaya metro station and Family Room complex (now “Mebel Park”), located in Rumyantsevo business centre. Both spaces gave Russian producers an opportunity to present their products in civilized formats.

Later around 10 more specialized shopping centres were introduced. The biggest one — 86 square-meter Roomer furniture centre was opened in the middle of 2013. At around the same time “Mandarin” shopping centre (20,500 square meters) and big furniture zone of “Konstructor” shopping complex (15,000 square meters). The most remarkable projects — “Imperia” specialized centre on Dmitrovskoe highway, “Tvoi Dom” on Ostashkovskoe highway, and “Sindika” specialized centre in Strogino.

How do we choose?

For years, experts from the furniture sphere in Russia have been arguing about what format is better for consumer — big one stop shopping hypermarket or classic furniture centre with traditional sections. Market conditions gave the answer. First and foremost, investors in Russia are more likely to invest in retail real estate, rather than global retail projects. Secondly, Russian furniture retail is presented mainly by retail chains of factories. As a rule they have small studio formats and are most comfortable in specialized centres.

Also, consumer in Moscow has made a definite choice in favor of big spaces, and furniture market has followed this trend. Even household-hypermarkets today prefer to integrate into existing shopping centres. A good example — Hoff chain, which is strengthening its positions on the Moscow market, opening new shops, integrated in either profile or multi-functional shopping centres.

At the same time, retail companies working in Moscow, are presented not only in shopping centres, but also in street retail.

“Less than half of our Moscow shops are located in profile shopping centres, the rest are separate studios, located in downtown or dormitory districts”, “Maria” CEO Efim Katz says, “Retail spaces located in furniture centres have their advantages, as well as studios. Shopping centres have high lease rate, but almost zero expenses on marketing. Location in downtown generates mass traffic, and this is its main advantage. For separate studios lease rate is much lower, but one needs to invest a lot of money in promotion. In downtown there are more people and sales, but the average check is higher in studios and there are more opportunities for displaying our unique offers. We appreciate both formats.

Classification

Moscow furniture centres can be classified by the following criteria: geographical, segment and conceptual.

Most retail spaces were opened based on the geographical factor. The reason is quite clear. In the last couple of years record volume of typical residential buildings were erected in Moscow and Moscow region. The city was surrounded by 3 chains of dormitory districts. Owners of retail real estate, supporting subrential projects, reacted to this situation. In most projects of this kind brokerage and management are conducted by a third part company. That’s how “Mebel Rossii”, “Mir Mebeli”, “Interier-Plaza”, “Mebel Box” and other companies work.

One more popular format, formally relating to subrential and increasingly supported by Moscow furniture retail — furniture zones in big shopping and entertainment centres and specialized centres. Main players of this market — Group of companies “Tashir” and Crocus Group. Lease holders are not their main clients, but Crocus Group has a good lineup of furniture producers supporting their hypermarket chain “Tvoi Dom”. “Tashir” works in the same way, arranging furniture zones in shopping and entertainment centre it owns — “Rio”, which is usually located next to “Tvoi Dom” hypermarkets. Companies work in different price range, that is why there is no competition between them. “Tvoi Dom” focuses on average plus and higher price segment, while “Tashir” orientates on average segment.

In addition to furniture spaces, integrated to “Rio” shopping and entertainment centre, “Tashir” also develops a separate profile project — “Leningradsky” designer centre. This is a classic interior design centre, offering a whole range of products in addition to furniture, including bathroom fixtures and home decoration materials.

Price matters

Moscow profile centres can also be classified by the segment criteria. However, in this sphere the situation has not changed significantly in the last 15 years. For example, the oldest furniture centres of Moscow — “Tri Kita” and “Grand” — retain their image of spaces specializing in goods with high prices.

To date “Grand” remains the biggest furniture centre in Russia, and many market professionals admit that it holds the title of the main furniture space. This is evident in the new marketing strategy of the shopping centre, which focuses on the variety of the products it offers. It should also be noted that “Grand” has the biggest advertising budget among Moscow furniture centres.

It’s also quite important that “Grand” is a certain kind of “display window” for many well-known furniture brands. Premium brands, both European and Russian, oftentimes choose “Grand” as a space for placing their flagship show-rooms.

Last year, for example, iconic company Roche Bobois chose “Grand” to display its products.

The product range of the second biggest Moscow centre — “Tri Kita” — partly overlaps with that of “Grand”. Their lists of leaseholders have the same names. However, “Tri Kita” also has its competitive advantages. For example, “Tri Kita” actively work with their retail customers. In the beginning of 2000s, it became well-known for its spectacular promo-concerts and draw games, which attracted a lot of customers. Today the furniture centre holds many exclusive events as part of its marketing strategy (monthly campaign “Night of cheap purchases”, coalition loyalty programs, as well as an online store).

“Armada” and “Imperia” centres are following in the footsteps of “Grand” and “Tri Kita”. However, there are certain peculiarities in the segment and the scale. “Grand” and “Tri Kita” — are regional formats, tribute to the 90’s, when Russian market was just saturating with product offering, opening to foreign companies. Probably, today none of the developers will venture to build a profile centre of similar scale. The focus is on small retail space and good location.

Conceptual role

Recently it became possible to classify furniture centres by criterion, which is new for the Russian furniture market — conceptual role. And this phenomenon can be considered a mental breakthrough. New concepts are based on research of specific tastes and requirements of certain consumer groups.

One of the first furniture centres, which made an attempt to set itself apart from mass-oriented retail spaces was “Twinstor”. It focused on architects and designers and chose its leasing pool following their expectations. Later Artplay exhibition centre, which created the biggest in Moscow gallery of interior designer boutiques, followed this example and started developing in the same direction.

In the mass segment Roomer furniture centre, located on Leninskaya Sloboda street, has definitely gained success. Since its launch, it positions itself as a platform for creative class.

Disturbing future

According to some experts, offer on the Moscow market of profile shopping centres surpasses demand at the moment. There are two-three shopping centres in each area of Moscow and, as consumer activity decreases, competition between these retailers increases significantly.

At the same time, representatives of federal retail are not considering cutting on retail spaces. Efficient centres are likely to survive in any, even the most difficult, situation — companies will strive to keep their expositions there. As for less popular and inefficient profile centres, they can expect optimization of rented space, at best, or their reduction, at worst.

At the same time furniture companies are not yet ready to forecast, how significantly Moscow retail will decrease. Moscow still remains the most important market for furniture producers, and no doubt they will be looking for various ways to preserve their positions.

Valeria Kononenko